Mergers, acquisitions, and corporate restructuring are complex transactions that involve various legal aspects to ensure compliance, protect stakeholders, and facilitate a smooth transition. The purpose of this analysis is to break down the legal aspects of merger, acquisitions, and corporate restrucy legal considerations in these corporate activities:

The Legal Aspects Of Mergers, Acquisitions, And Corporate Restructuring

Table of Contents

Toggle1. Due Diligence:

- Financial Due Diligence: Examining the financial health of the target company to identify risks and liabilities.

- Legal Due Diligence: Assessing legal contracts, obligations, litigation, and regulatory compliance of the target.

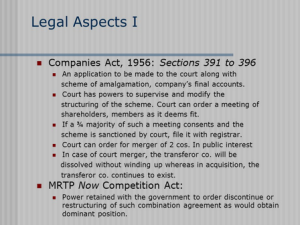

2. Regulatory Compliance:

- Antitrust and Competition Laws: Complying with antitrust and competition laws to prevent anti-competitive behavior.

- Industry-Specific Regulations: Adhering to regulations specific to the industry in which the companies operate.

3. Transaction Structure:

- Asset Purchase vs. Stock Purchase: Choosing between acquiring assets or shares, each with different legal implications.

- Merger Types: Deciding on the structure of the merger, whether it’s a merger of equals, reverse merger, or triangular merger.

4. Contractual Agreements:

- Letter of Intent (LOI): Outlining the basic terms and conditions before entering into detailed negotiations.

- Definitive Agreements: Drafting comprehensive agreements, including the Purchase Agreement, Merger Agreement, and Shareholders’ Agreement.

5. Employee Issues:

- Employee Contracts and Benefits: Reviewing and addressing employment contracts, benefits, and potential workforce changes.

- Labor Laws: Complying with labor laws related to employee rights and potential layoffs.

6. Intellectual Property (IP) Rights:

- IP Due Diligence: Assessing the target company’s IP portfolio and addressing any infringement issues.

- IP Assignment and Licensing: Ensuring proper assignment or licensing of IP rights in the transaction.

7. Tax Implications:

- Tax Planning: Structuring the deal to optimize tax implications for both parties.

- Tax Due Diligence: Assessing the tax history and potential liabilities of the target company.

8. Litigation and Dispute Resolution:

- Litigation Risks: Identifying existing and potential litigation risks and liabilities.

- Dispute Resolution Mechanisms: Including dispute resolution mechanisms in agreements, such as arbitration or mediation.

9. Securities Law Compliance:

- SEC Filings: Complying with Securities and Exchange Commission (SEC) regulations for publicly traded companies.

- Disclosure Requirements: Meeting disclosure requirements for shareholders and regulatory bodies.

10. Financing Arrangements:

- Financing Agreements: Structuring financing arrangements and complying with financing conditions.

- Debt and Equity Considerations: Balancing debt and equity components in the financing structure.

11. Environmental Compliance:

- Environmental Due Diligence: Assessing environmental risks and liabilities associated with the target company’s operations.

- Compliance with Environmental Laws: Ensuring compliance with environmental laws and regulations.

12. Cultural Integration:

- Corporate Culture: Assessing and addressing cultural differences between the merging entities.

- Employee Integration: Planning for the integration of employees and fostering a cohesive organizational culture.

13. Government Approvals:

- Regulatory Approvals: Obtaining necessary regulatory approvals from government agencies.

- Shareholder Approval: Securing approval from shareholders through meetings or voting processes.

14. Post-Closing Obligations:

- Transition Services Agreements: Establishing agreements for services needed during the transition period.

- Earn-Out Provisions: Including earn-out provisions based on the future performance of the acquired company.

15. International Considerations:

- Cross-Border Transactions: Navigating legal complexities in cross-border mergers and acquisitions.

- Foreign Investment Laws: Complying with foreign investment laws and regulations in the countries involved.

Conclusion:

Navigating the legal aspects of mergers, acquisitions, and corporate restructuring requires a comprehensive understanding of various legal domains. Engaging legal professionals, including corporate attorneys, tax experts, and regulatory specialists, is crucial to ensure compliance with applicable laws and regulations. Thorough due diligence, strategic planning, and meticulous documentation are essential to mitigate risks, protect stakeholders’ interests, and achieve a successful outcome in these complex transactions.